Few investments offer the same wealth-generating opportunities and quick access as stocks. It’s easy to buy stocks with a brokerage account, but some brokerage accounts are better than others. Some accounts have features designed to help you save money and discover investment opportunities that can multiply your returns.

Investors can benefit from comparing brokerage accounts before choosing the right one for them. Furthermore, it’s also common for investors to have accounts with multiple brokerage firms. Whether you are a new investor who is just getting started or a seasoned pro who is looking for a new experience, these are some of the top brokerage accounts to consider.

Fidelity

Fidelity is one of the most established brokerage firms. It offers a wide range of ETFs and mutual funds that have low expense ratios. You won’t have to pay any commissions for making stock trades, and options have a $0.65 fee for each contract.

Key details:

- Fidelity has many ETFs and mutual funds with low expense ratios, which makes it easier for passive investors to earn solid returns.

- Great customer support

- Fidelity offers many educational resources so you can keep up with the stock market and learn the fundamentals

Who should open this account:

Fidelity is the most suitable choice for long-term investors who want to buy and hold assets. It has trading tools like Active Trader Pro, but it’s better for long-term investors.

SoFi Invest

SoFi is one of the largest online banks and lenders, but those aren’t the only areas where it shines. SoFi Invest gives investors access to pre-IPO companies and offers a 1% match on all IRA contributions.

Key details:

- SoFi offers IRA matching and pre-IPO companies which helps it stand out.

- There are no fees for stock trades. SoFi has a $5 fee for options assignments and exercising options.

- The trading tools aren’t the best if you are an active trader.

Who should open this account:

SoFi Invest is optimal for long-term investors who want access to pre-IPO stocks and an IRA matching program. It’s also a great resource for options traders since you only pay fees if your option gets exercised or assignment. Closing the position before the expiration date can help you avoid the fee. However, you’ll need good trading software, since SoFi doesn’t have many trading tools.

Interactive Brokers

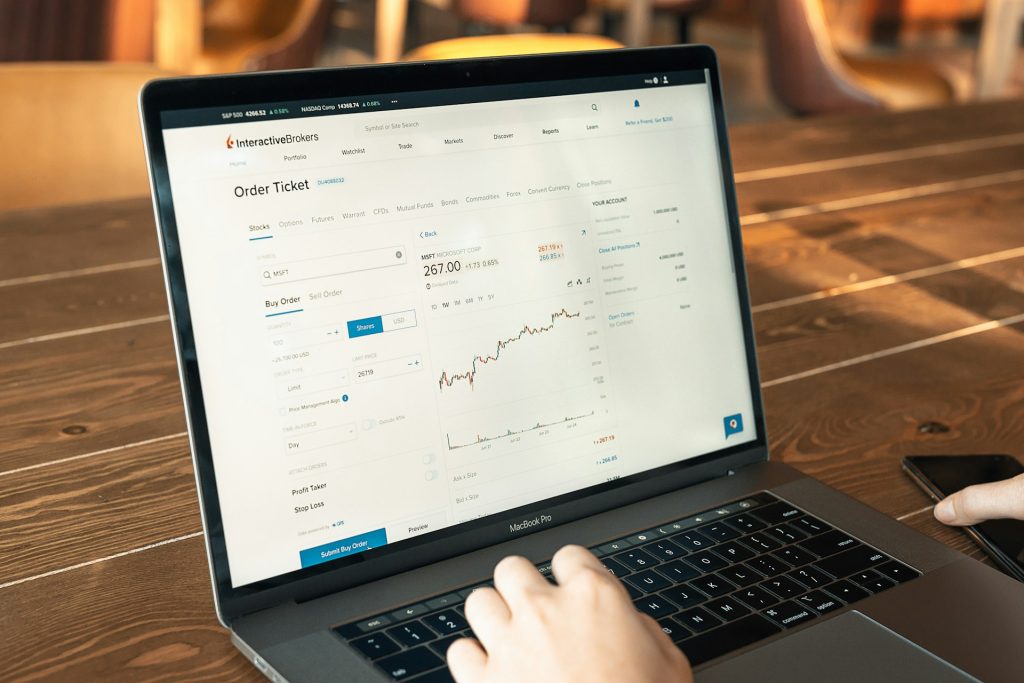

Interactive Brokers has recently seen a steady uptick in new users, and margin rates are a big reason why. The broker has been around for more than 40 years and offers competitive rates. You can also view a candlestick chart of any stock before trading it. Interactive Brokers offers more information about a stock on its order tickets than most brokerage accounts.

Key details:

- Margin rates range from 4.83%-6.83%, while most brokers start with APRs above 10% for small accounts.

- Get easy access to fundamental and technical indicators before placing an order on any stock.

- Interactive Brokers lets investors trade cryptocurrencies.

Who should open this account:

Interactive Brokers has a learning curve, but it’s a rewarding brokerage account for people who master it. You can get quick access to any stock’s fundamentals, ratios, competitors, and other valuable information. Interactive Brokers also has some of the best margin rates in the industry, making it less costly to borrow money.

Robinhood

Robinhood makes it easy to trade stocks, options, and crypto. Active investors regularly use Robinhood, but the brokerage account also offers benefits for long-term investors. Robinhood features an IRA match, low margin rates, and additional perks you can unlock with Robinhood Gold.

Key details:

- 1% IRA match (3% match if you use Robinhood Gold)

- You can trade 19 cryptocurrencies on Robinhood

- The highest margin rate is currently 5.75%, and it drops to as low as 4.75%.

Who should open this account:

Active investors who want an easy-to-use interface may benefit from Robinhood. Pairing your brokerage account with a Robinhood Gold membership can help you unlock a 3% IRA match which is hard to find. The IRA match and other perks like the Robinhood Gold Card (unlimited 3% cashback on all purchases) can pay for the Robinhood Gold membership.

Ally Invest

Ally Invest has no trading fees for stocks. The brokerage account has a competitive $0.50 contract fee for each options trade. Ally Invest integrates with TipRanks to provide each stock with a Smart Score and analysis tools. Investors can integrate their Ally Bank account to capitalize on high yields.

Key details:

- You can use Ally Invest’s robo portfolio to get assistance with your investments.

- Competitive options trading fees

- TipRanks integration offers a wide range of data points that can help you make better investing decisions,

Who should open this account:

Ally Invest is a great choice for options traders who want lower fees with each trade. It also serves as a good resource for people who already have bank accounts with Ally. Investors who want TipRanks’ analytics will also benefit from this brokerage account. It’s a beginner-friendly platform as well.

How to Choose the Best Brokerage Account for Your Portfolio

Investors can choose from several brokerage accounts, but some are better than others. These are some of the factors you can use to gauge which brokerage account makes the most sense for your portfolio.

Commissions

Most brokerage accounts have zero trading commissions for stock and ETFs. However, many brokerage accounts charge fees for options trades. If you trade options, you may want to narrow your search to brokers that have lower options contract fees. Furthermore, some brokerage firms offer better access to low-fee ETFs than others.

Investment Options

While brokerage accounts offer access to stocks and ETFs, others provide access to additional assets. Not every brokerage account gives you access to bonds and mutual funds. Even fewer accounts give you access to cryptocurrencies. If you want to buy Bitcoin in your brokerage account, you should narrow your search to accounts that support crypto trading.

Customer Support

You will likely have questions about using your account and capitalizing on the best features. A good customer support team can answer your questions and address any issues quickly. Some brokerage firms do better with customer service than others, and you can read online reviews to gauge a company’s customer support quality. It’s also good to see how many ways you can contact customer support. Many brokerage firms have email, phone, and live chat support.

Tools and Features

Brokerage firms offer tools and features to give investors access to more data points, so they can make better decision. However, some companies offer better features than others. While buy-and-hold investors can typically get by with limited tools and features, day traders need a wide range of tools to make a profit. Day traders should assess the quality of a brokerage account’s trading resources or consider a trading software in addition to a brokerage account.

Interest Rates on Idle Cash

Not every investor pours all of their capital into the stock market. Some people prefer to keep extra cash on standby, but those funds can continue to grow with a good interest rate. If you keep money on the sidelines, you should check the APY that each brokerage account offers for those funds.

Frequently Asked Questions

How much money do you need to open a brokerage account?

Most brokerage accounts do not require minimum deposits to open an account. Some brokerage firms may require a $100 minimum deposit, but you can get started with most brokerage accounts before connecting a bank account.

Is it a good idea to have a brokerage account?

It is a good idea to have a brokerage account. This account allows you to invest in stocks, ETFs, mutual funds, bonds, and other investments. Some brokerage accounts also let you invest in cryptocurrencies. Investing makes it easier to retire and scale your wealth, as your dollars get to work harder for you.

How do you open a brokerage account for beginners?

After comparing brokerage accounts, you can right a brokerage firm’s website and start the account creation process. You will have to provide some personal details, such as your name and email address, when creating an account.